Help Wanted

The largest contractor associations and building-trade recruiters, merit shop (see www.abc.org) and Union (see www.helmetstohardhats.org) recruit & train temporary labor pools. The free on-the-job training for indentured apprenticeships are registered at State levels, and governed under the same colonial laws for indentured servitude during the slave trade. Lexis-Nexis legal searches describe the joint apprenticeship legal structure as a shelter against most liability, except proven civil rights violations, where plaintiffs who prevail are awarded attorney fees and rights to return to the apprenticeship.

Typical 4-year apprenticeships are subject to academic boot camps, and sponsoring contractors, who prohibit truancy, or performance issues. State indentured apprentice programs permanently terminate failed students from enrolling in the same program.

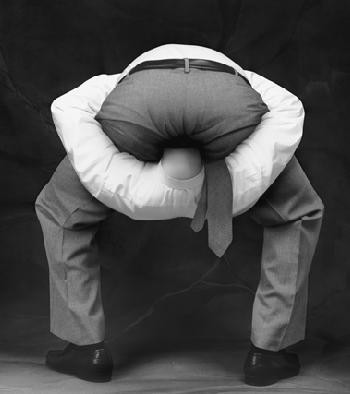

Refusing to participate in workplace hazards or frozen fear is not well received, without justification. Most workers are averse to halting production to enforce “Safety First”, when the only justification comes from the local chain of command, jobsite foremen, or apprenticeship administrator; all negotiating production pressure with sponsoring contractors.

Co-workers can be afraid to join whistleblowers, with the prospect of a career-disruption event, an immediate end to livelihood with sponsor contractors. OSHA will not investigate before an occupational casualty. The hat gets passed around asking $2.ea for bereaved family and administrators get nervous breakdowns dealing with casualties.

Predatory Trade Schools

Indentured apprentices don’t need to consider the prospect of student loans for academic trade schools, or bear burdens of hustling on-the-job-training (OJT) with academic job-placement departments. Predatory trade schools also flunk students for truancy, but keep the student loan intended for the entire curriculum thru graduation.

With the 2005 Bankruptcy Abuse Prevention and Consumer Protection Act, followed by some student loan payment restructuring acts, most US student-loan nullification was removed. Student loan hardships are no longer granted, before wage garnishment of 10% income is mandated at least 20 years. After the global economic collapse of 2008 from un-regulated mortgage accounting, predatory lending quickly shifted from mortgage loans to the more lucrative student loans.

Labor Saturation

With such abundance of labor in training from trade schools, and indentured-apprentice programs, at a fraction of journey level prevailing wage, jobs are run with as few journeymen as possible, since higher payroll taxes must be justified. Journeymen who try to keep trade knowledge guarded, and keep apprentices under the bus, did not avoid sitting on wait lists between fewer projects. Sustained by State unemployment, this variable employment inevitably drives these desperate, under-employed workers into unlicensed residential side work.

Along with unlicensed freelancers, undocumented laborers, under-reported payrolls, under-insured helpers, missing workman’s compensation insurance, workplaces gamble against injury claims and accident attorneys.

With such abundance of exploitable labor on Craigslist.org alone, from laborers and semi-skilled apprentices, to side-working journeypersons from trade schools, ABC, and IBEW, periodic reports of a construction-skills shortage could refer to a lack of trade-job stability, and fewer career-developed tradespersons becoming inspectors.

Complete Regulatory Failure

Unqualified-employee certification failures (CLC Newsletter, Fall 2010), is another case where the desire of law is vastly different from compliance defacto. In my experience laborers have dominated jobsites with superior motivation to avoid government authority, which may be notoriously corrupt in their country of origin.

As the eyes and ears of State Wide Investigative Fraud Teams (SWIFT), licensed competitors have leveled the playing field with a can’t-beet-them-join-them approach.

In 2016 the Contractors State License Board (CSLB) reported over 50% of all licensees declare themselves exempt from worker compensation (WC), for work not practical without employees. To deal with this industry practice of avoiding WC insurance, a new law grants CSLB representatives the authority to issue citations, without a peace officer, or district attorney. Presumably during SWIFT sting operations. (CLC Newsletter, Winter 2015-16)

Licensed contractors are also structuring their businesses with partners or corporate officers as help, so some labor regulations, payroll deductions, and perhaps consumer protections, become the oversight burden of governments with limited enforcement or tax-audit resources.

A California contractor’s licenses may be automatically suspended by operation of B&P §7125.2 for under-reported payrolls, or lacking worker’s comp. for helpers that don’t meet independent-contractor tests. Courts also punish property owners if both; 1) the injured were unlicensed, not a statutory employee, and 2) a builders license was required, CLC §2750.5.

Remodels, additions, or alteration by owner builders

Helpers hired by contractors are never covered by property insurances, which void any associated injury claims. The best leverage against liability for owners hiring contractors with helpers is to secure proof of Workman’s Comp Insurance, and a Certificate of Additionally Insured from the contractor’s General liability policy.

The common Certificate of Additionally Insured from a General Liability policy allows victims to file claims any time, regardless of contractor’s that disappear, go out of business, change names, or license numbers.

Beware of property-insurance policies selling Workers Comp riders, since any construction before certificate of occupancy, or any independent contractor is excluded by law, CLC §3357. Policy underwriters further limit WC riders to 40-total man hours per week, and claims are void unless the injured are statutory employees. CA Ins. Code §11590 mandates that only “Comprehensive Personal Liability” must cover bodily injury of employees within the first 52 hours worked, unless excluded as an independent contractor.

During the Permit process, consumers are advised to weed out credit risks, corporate name changes, and fraudulent license numbers, enforce down-payment limits, escrow accounts, and lien releases after each phase of the project. See Rebuilding After a Natural Disaster Video produced for the Contractors State License Board (CSLB).

Open Permits

Motivated complainers are the rats that reform the commerce. Disgruntled neighbors, unpaid contractors, losing bidders, or licensed competitors may file CSLB complaint forms, or complain to code enforcement. The municipality can revoke occupancy for building-permit violations, per International Building Code (IBC) § 18.90.120 (.20) adopted throughout the States.

Construction that avoids permits with municipal inspection is often discovered later. If not by complaints to code enforcement, then by banks, and title companies who discover mechanics liens, or open permits. When DIY alterations occur or additions exist with open permits, law compels disclosure, or “Sold As Is” when selling US Real Estate. Regardless how home inspectors may expose hazards during property sales, insurance-claim adjusters are well aware that owner-builder alterations with hazards, and remodels with Permit violations are common. Unless proven otherwise, claims investigations are justified presuming negligent hazards were involved in the casualty claim.

Authority Having Jurisdiction

If fire investigators found fuel residue on your burned-down property, arson would be suspected. Similarly, when casualty claims occur, all owners and the unqualified persons they hire are expected to have installed hazards, improper fuses, bypassed safety devices, and avoided permits and inspections.

The fire codes are a matter of public policy; with established judicial precedents that began with requiring unlocked fire exits, smoke, and CO detectors International Residential code (IRC) R314-R315).

Given the environment of negligent alterations, and remodels without permits, the insurance industry wants to spread liability around to other responsible parties. Code-making panel members are represented by insurance-industry litigators who have declared insurance inspectors an Authority Having Jurisdiction (AHJ), directly in the National Electrical Code (NFPA-70) § 90.4, 90.7, & 110.2, adopted thruout the States.

Property Insurance Claims

Contingency attorneys specializing in insurance claims consider cases where settlements are likely, and may involve previous owners, checking bad-faith Insurance, unconscionable policy language, or procedures.

We see smoke damage

and fire claims denied for a wide range of reasons. Insurance companies will

sometimes accuse their insureds of starting the fire intentionally. Other

denials are based on “protective safeguard” policy forms, which insurance

companies use to deny claims if there was no fire alarm or smoke detector.

Denial letters cite to vacancy provisions, insurance application answers, and

concealment provisions.

Policyholders who have experienced fire losses go through the worst combination

of loss to their property and invasive investigation by their insurance

company. Insurance companies will ask for financial records and a multitude of

other documents. They will demand sworn testimony in the form of an Examination

Under Oath. Some insureds are so worn down by the delay and intimidated by the

investigation process that they give up their claims.

Taken from Tetzel Law:

Fire insurance claims may be denied over errors made on a form or simply from lack of enough documentation that you are able to provide. The insurer, though, does have to offer an explanation for why your claim was denied.

If the reason was suspected arson or some fault of yours that the policy lists in its exclusion provisions, hire an independent investigator to undertake another investigation and prepare a written report if it is at odds with the insurer’s report and reason for denial. Your investigator should document that your home safety or fire alarm systems and smoke detectors were fully functioning and that your home was up to code. Once the report is complete, submit it for the insurer’s review. If it does not change their opinion, your policy will have provisions and instructions for filing an appeal.

Limits of Inspections

Insurance adjusters are well aware nothing prevents alterations after inspection passes, such as replacing modern light fixtures with unlisted home-made chandeliers, or other fire hazards. Municipal inspectors check code issues that are visible without covers or barriers. Fire hazards in crawl spaces or behind walls remain sight unseen, just as jobsite labor issues or workers comp. are not investigated before injury claims.

It’s Too Complex

The insurance industry, and NFPA code-making members are also aware different inspectors may not agree on interpretation of the National Electrical Code (NEC). Proper application requires access to references that point to proprietary publications, not published by the same standards body, and locked behind paid firewalls.

Code topics are often fragmented across different chapters without references to each other, and key-word searches for code-jargon definitions are missing entirely, across nearly 1000 double-columned pages.

Simplicity was lost when the NFPA replaced simple formulas with proprietary lookup

tables. Most errors are made either applying the wrong table limits, or

miss-applied adjustment & derating schemes for different environments.

Anyone working thru NEC chapter 220 load calculation tables, who can match the values shown in Annex D example D3(a), can’t get anyone else to understand how they did it. Therefore, a universal “Exception” for all things “under engineering supervision”, allows the simpler IEEE standard formulas typically preferred by architects, planning, or engineering departments.

Declaring its “not intended as an instruction guide”, the NEC is devoid of any photo examples, or reference to National Electrical Contractors Association (NECA) standard guides, or illustrations that Mike Holt publishes. In its current form, municipal inspectors should be expected to continue disagreeing with each other, and remain infamous for interpretive improvisations to fill in the information gaps.

Inspector Trade Groups and Executive Golden

Parachutes

After sacrificing their editing department, and financing new executive compensation, the International Association of Electrical Inspectors (IAEI), and their flagship Magazine continues a notorious tradition of featured electrical-code articles and illustrations riddled with errors.

After sacrificing their membership department for newly-constructed corporate headquarters, perhaps a last redeeming quality remains the volunteer members who manage the local-chapter budgets, to provide inspectors with continuing education units (CEU).

Some local chapter experts can settle code interpretation between municipal inspectors, if taught by seasoned planners with electrical-contractor backgrounds, however where retained on volunteer basis such talent is rare.

Combination inspectors with several different building code standards on their plate regard the NEC as the most difficult of all code arrangements. In order to see light beyond the tunnel, IAEI chapters advise inspectors to pay ~$1200 USD out of pocket, to travel cross country to rub elbows with NFPA code-making panel members.

Inspection Overload and Oversight

While California’s municipal combination inspectors are tasked to recognize violations with Fire, Energy code, Structure, Plumbing, Air conditioning, and Electrical code issues, at best they are jack of all and master of none.

In my experience, many inspectors don’t grasp changes to “Replacement Code” NEC 406.4(D) that CA adopted over 10-years ago, which removes the “Grandfathered” concept for outlet replacements. Inspectors are not enforcing requirements for all GFCI, AFCI, and Tamper Resistant outlets, replaced during remodels they inspect.

NEC 90.4 may allow AHJ’s to error on the side of caution. However, forcing a complete building rewire due to ignorance of 406.4(D)(2) is not safer, especially during low-level faults that don’t trip standard breakers.. Neither is completely missing 406.4(D)(4) during an inspection considered erring on the side of caution.

While my observations are limited to residential wiring, others publish similar observations with industrial and commercial inspection issues.

These inspection gaps are left for other AHJ’s; such as insurance inspectors and forensic-claim investigators, who can take their time matching Code or product-Listing violations with established judicial presidents, and prove why casualty claims are denied, not legally insurable with such fire-code violations.

Specialization thru Comparative Advantage

The standards that property insurance demands may differentiate

contractors who are specialized enough to make those requirements a point in

their bid policy. However, the economy is not driven by developers incentivized

by insurance standards. Developers demand indemnity from sub-contractor

negligence, as do inspector municipalities issuing permits; neither are party

to the cause insurance may find for denying some future claim.

However, code defines property owners with equal right and responsibility as

Authority Having Jurisdiction (AHJ) during construction or alterations. Perhaps,

having the only skin in the game, owners that hire ignoramuses do so at their

own peril, since owners bear all losses after those contractors are long gone.

Updated 12/04/2019